Bitcoin’s Unique Position in the Cryptocurrency Landscape

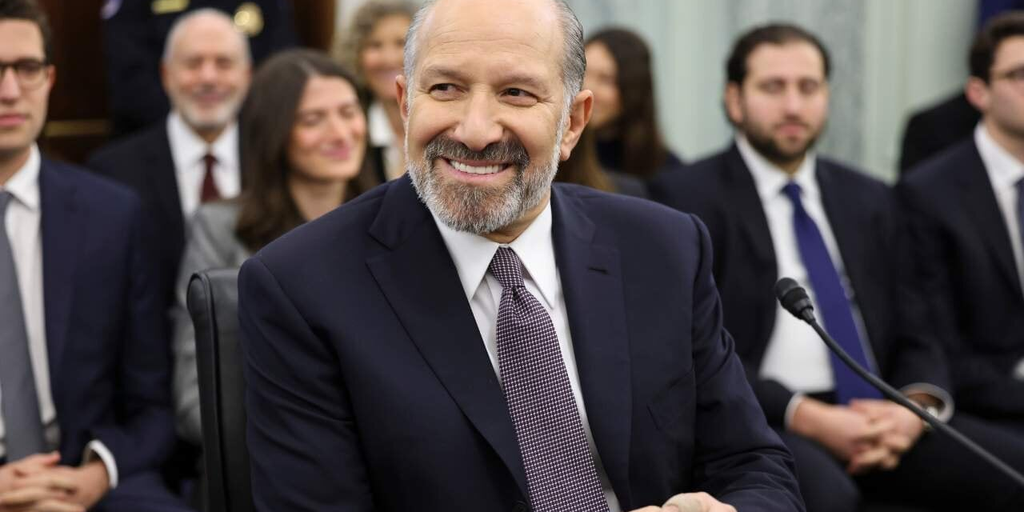

As the cryptocurrency market continues to evolve, Bitcoin is poised to maintain a distinct status within the realm of digital assets. According to recent statements from industry experts, including prominent figures like Lutnick, Bitcoin is not just another cryptocurrency; it is set to be recognized as a central reserve asset. This announcement is expected to reshape the way investors and institutions view Bitcoin and its altcoin counterparts.

The Significance of Bitcoin as a Reserve Asset

Bitcoin’s unique attributes have positioned it as a digital gold of sorts. Here are some key reasons why it holds a special place in the cryptocurrency ecosystem:

In light of these characteristics, Lutnick’s assertion that Bitcoin will hold a unique status among cryptocurrencies is not surprising. It suggests a growing recognition of Bitcoin’s potential to serve as a safe haven for investors, especially in times of economic uncertainty.

Altcoins: A Positive Yet Differentiated Approach

While Bitcoin is set to take center stage, altcoins will continue to play a vital role within the cryptocurrency market. Lutnick’s remarks indicate that altcoins will be treated “positively, but differently.” This differentiation is crucial for several reasons:

As Bitcoin solidifies its position as the primary reserve asset, altcoins will likely find their niche within the broader cryptocurrency ecosystem. Investors will need to adopt a nuanced approach, recognizing the potential of altcoins while being aware of the inherent risks associated with them.

Implications for Investors and Institutions

The anticipated announcement regarding Bitcoin’s reserve status is expected to have profound implications for both retail and institutional investors. Understanding how to navigate this evolving landscape will be crucial for maximizing opportunities and mitigating risks.

For Retail Investors

Retail investors should consider the following strategies as Bitcoin gains recognition as a reserve asset:

For Institutional Investors

Institutional investors are likely to adopt a more strategic approach as they navigate the implications of Bitcoin’s reserve status:

Conclusion: The Future of Bitcoin and Altcoins

As we approach the anticipated announcement regarding Bitcoin’s reserve status, it becomes increasingly clear that the cryptocurrency landscape is on the brink of transformation. Bitcoin’s unique characteristics position it as a vital asset for investors looking for stability and value preservation. Simultaneously, altcoins will continue to innovate and serve diverse roles within the market.

For both retail and institutional investors, understanding these dynamics will be essential for navigating this exciting and rapidly evolving ecosystem. As Bitcoin stands ready to claim its place as a central reserve asset, the future for cryptocurrencies, both Bitcoin and altcoins, looks promising. Adapting to these changes will require awareness, strategic planning, and a commitment to ongoing learning in the world of digital assets.